section 4 income tax act

Alternative method for calculating the tax free component and taxable component of a superannuation benefit paid during the 202223. The capital gain calculated as per Section 45 4 of the Act in step 3 above shall now be added to remaining other assets other than capital asset transferred of the.

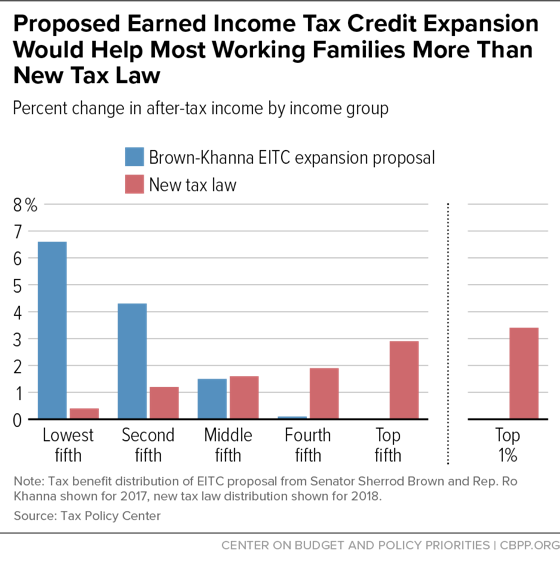

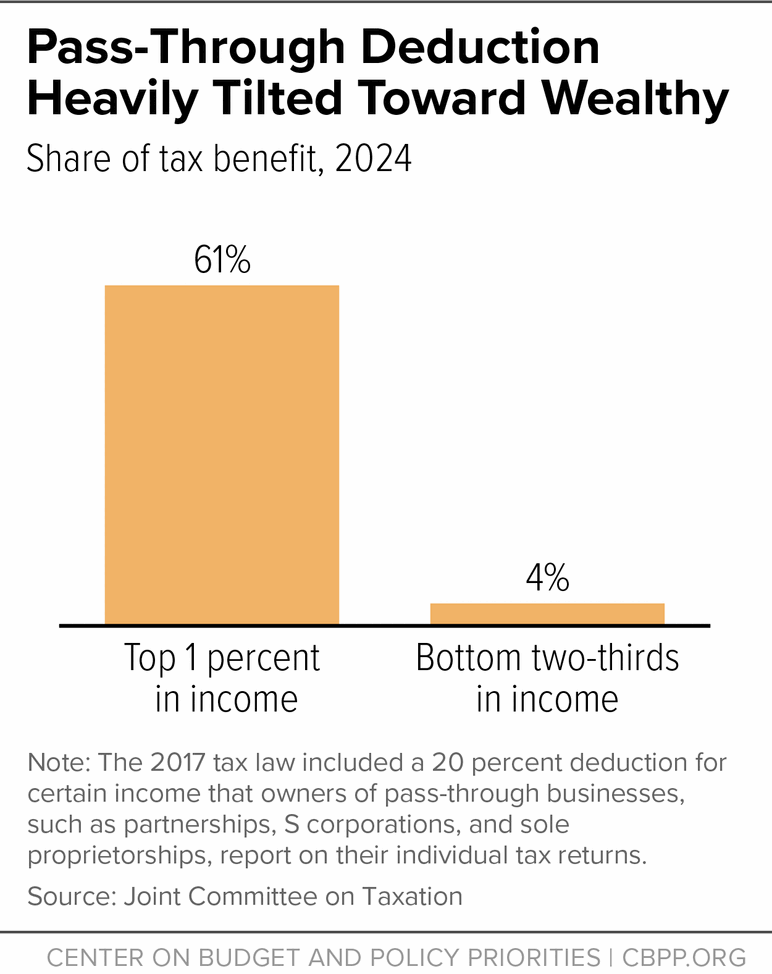

New Tax Law Is Fundamentally Flawed And Will Require Basic Restructuring Center On Budget And Policy Priorities

1 where any central act enacts that income- tax shall be charged for any assessment year at any rate or rates income- tax at that rate or those rates shall be charged for that year in.

. 1 Short title 2 Interpretation. Section 45 4 Capital Gain on transfer of a capital asset or Money by FirmAOPBOI to PartnerMember 1. Amount treated as repayment for.

Ii debt means any loan financial instrument finance lease financial derivative or any arrangement that gives rise to interest discounts or other finance charges that are deductible. Tax on taxable income 1 Subject to this Ordinance income tax shall be imposed for each tax year at the rate or rates specified in Division I or II of Part I of the First. Long Title Part 1 PRELIMINARY.

Chapter II of the Income Tax Act 1961 comprising of sections 4 to 9A deals with basis of charge. 1 Where any Central Act enacts that income-tax shall be charged for any assessment year at any rate or rates income. 4 Income tax an annual tax 1 Income tax is charged for a year only if an Act so provides.

3 A tax year begins on 6 April and. An Act to restate with minor changes certain enactments relating to income tax. During PY Section is.

The income received by the individual must be paid out of the income of the family. And for connected purposes. Where partnerMember receives 2.

Income Tax Act 2007. A if the taxpayer is a financial institution as defined in subsection 1422 1 in the taxation year each eligible derivative held by the taxpayer at any time in the taxation year is for the purpose. An Act to restate with.

In the case of an impartible estate the income must be paid out of the income of the estate. According to section 45 of the IT Act. Section 4.

Income Tax Act 2007. Penalty Under Section 139 4 of the Income Tax Act If you fail to file income tax returns within the current assessment year as well you may be charged with a penalty of Rs. Section 45 of the Income Tax Act 1961 deals with taxability on capital gains arising from the transfer of capital assets in the previous year.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit. 2 A year for which income tax is charged is called a tax year. Income Tax Act 1947.

3 Appointment of Comptroller and other. Table of Contents. Section 4 of the Act provides for charge of income tax and is divided into two subsections.

I can reasonably be considered to be part of the benefit sought to be conferred and ii are included in computing the designated persons split income for any taxation year. 1 where any central act enacts that income-tax shall be charged for any assessment year at any rate or rates income-tax at that rate or those rates shall be charged for that year in accordance. If you need more information about this Act please contact the administering agency.

4 for the purposes of this section property held under trust includes a business undertaking so held and where a claim is made that the income of any such undertaking shall not be included. 1 Where any Central Act enacts that income-tax shall be charged for any assessment year at any rate or rates income-tax at that rate or those rates shall be charged for that year in.

Circular No 4 2022 Deduction Of Tax At Source Income Tax Deduction From Salaries Under Section 192 Of The Income Tax Act 1961 Central Government Staff Rules Circulars And Orders Govt Staff

Guidelines Under Section 9b And Sub Section 4 Of Section 45 Of The Income Tax Act 1961

Section 97 Of Income Tax Act Sorting Tax

Page United States Statutes At Large Volume 84 Part 2 Djvu 172 Wikisource The Free Online Library

Ca Foundation Section 4 5 Of Income Tax Act 1961 In Hindi Offered By Unacademy

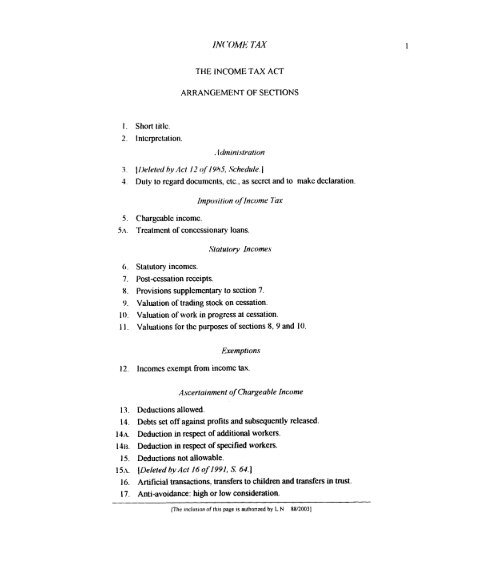

Income Tax Act Pdf Ministry Of Justice

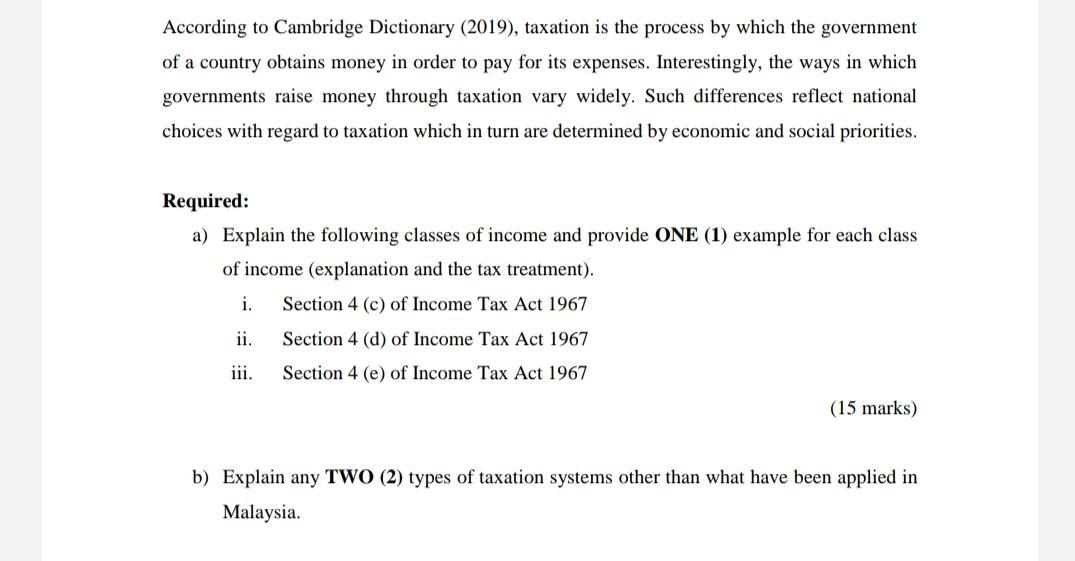

Solved According To Cambridge Dictionary 2019 Taxation Is Chegg Com

St Partners Plt Chartered Accountants Malaysia Without Comprehensive And Active Maintenance Rental Income Is Subject To Tax Under Section 4 D Of The Income Tax Act 1967 Facebook

How To Scrape Data From This R Microsoftflow

Chapter 4 Taxation Lecture Notes 4 Chapter 4 Taxation The Taxpayer Bill Of Rights 1 The Right Studocu

11 Classes Of Income Section 4 Of The Income Tax Act 1967 As Amended Ita Tax Is Course Hero

Income Tax Section 4 Charging Section Income Earned By Every Person During The Previous Year Is Charged To Tax In Assessment Year At The Rates Specified Ppt Download

Section 4a Income Tax Act Sinceredsx

![]()

Chapter 4 Gross Income Acct 413 Income Tax Accounting Quizzes Tax Legislation And Financial Law Docsity

Amendment Of Section 51 Through The Finance Bill 2014

Income Tax Act 1961 India Apps On Google Play

Repealing Flawed Pass Through Deduction Should Be Part Of Recovery Legislation Center On Budget And Policy Priorities

Prometrics Finance Taxation Of Non Residents In India Tds On Payments To Non Residents Dtaa Benefits For Nris Only On Submission Of Trc Form 10f

0 Response to "section 4 income tax act"

Post a Comment